Moreover, financial statements are released on a regular schedule, establishing consistency of external information flows. This uniformity allows investors, lenders, and analysts to compare companies directly on the basis of their financial statements. Securities and Exchange Commission (SEC), establishes financial accounting rules in the United States. The sum of these rules is referred to as generally accepted accounting principles (GAAP).

Global organizations trust Net Zero Cloud to help them meet their ESG goals.

Financial reports and data can be presented in any way, as long as the individuals intending to use them are satisfied and can use them to make decisions. On the other hand, managerial accounting does not have to fulfill any form of general standards. Managerial accounting only has to fulfill internal standards and principles set to achieve business goals.

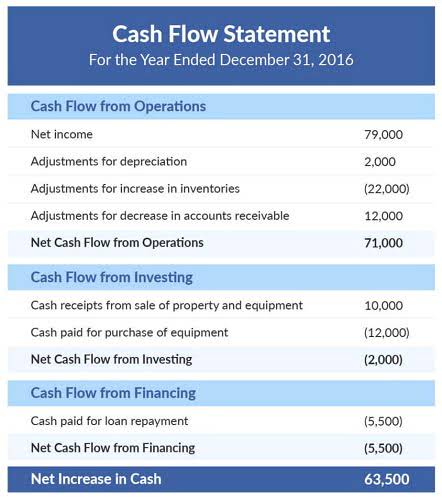

- Cash flow analysis is the examination of these inflows and outflows of cash during a particular period under consideration.

- Most other companies in the U.S. conform to GAAP in order to meet debt covenants often required by financial institutions offering lines of credit.

- “A career is advanced through demonstrated competency and through visibility,” he says.

- Managerial accountants engage in cash flow analysis to identify the impact of business decisions on the cash flow of a company.

- This report breaks down the remaining balances of your clients into specific time periods allows managers to identify the debtors and identify issues in the company collection process.

- They are also responsible for managing risk, planning, strategizing, and decision making.

What are the functions of managerial accounting?

Through this technique, managerial accountants ensure that the company’s true capital is determined, preserved, and maintained. Financial statements are made more accurate and forecasts for future asset valuation become easier and more reliable. Financial planning is a culmination of other techniques involved in achieving the internal goals of an organization. It involves the analysis of comparative financial statements and accounting ratios and the use of generated data to plan for the future. Proper cash flow analysis gives managerial accountants and administrators a chance to optimize the flow of cash within a company. The time when reports and statements are generated for use is different between managerial and financial accounting.

What Types of Accountants Make the Most Money?

- Requirements to enroll in the CMA program include membership to the IMA, payment of a program fee, a bachelor’s degree from an accredited university, and at least two years of consecutive professional experience.

- Dedicated to its motto, Ut Prosim (That I May Serve), Virginia Tech pushes the boundaries of knowledge by taking a hands-on, transdisciplinary approach to preparing scholars to be leaders and problem-solvers.

- Companies should calculate an initial emission benchmark and track reduction efforts across time (for example, annually).For most organizations, calculating carbon emissions is just the first step.

- Managerial accounting is very effective in highly competitive and fast-paced business environments where quick decisions need to be made.

- Analyses are often focused on targeted segments of a business rather than on a company as a whole.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

You can also view a summary of companywide travel emissions across air and ground travel and hotel stays. Access framework-specific report builders for CSRD, SASB, GRI, and CDP reports, with more to come as needed. Create reports in Microsoft Word with a Microsoft 365 plug-in, giving you a cleaner interface, complete with collaboration functionality, easier navigation, and rich text support.

- Some of these reports include budget managerial reports, account receivable aging reports, performance reports, and cost managerial accounting reports.

- Results are not prioritized by what calculations are the most correct but by their impacts on the desired outcome.Last, accountants should be able to garner trust from other departments through stewardship.

- Both financial professions work with financial information in similar ways, but for different purposes and uses.

- The median annual salary for accountants and auditors in 2021, according to the Bureau of Labor Statistics.

- Business managers collect information that feeds into strategic planning, helps management set realistic goals, and encourages efficiently directing company resources.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

How confident are you in your long term financial plan?

Through a review of outstanding receivables, managerial accountants can indicate to appropriate department managers if certain customers are becoming credit risks. If a customer routinely pays late, management may reconsider doing any future business on credit with that customer. Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to https://www.bookstime.com/articles/process-costing complete their financial statements in accordance with GAAP as a requisite for maintaining their publicly traded status. Most other companies in the U.S. conform to GAAP in order to meet debt covenants often required by financial institutions offering lines of credit. One of the most common ways for tax and accounting firms to improve efficiencies, which can lead to better time management, is to introduce some measure of automation.

Net Zero Cloud Pricing

- These reports provide information to people who are interested in knowing about the financial aspects of a business.

- Simplify ESG reporting by using MuleSoft to connect with apps from partners in the App Exchange.

- The management of a business makes use of the information to evaluate and analyze a company’s performance and financial position.

- Accountants in this department make use of the cost of products and services, the sales revenue, as well as the budget of the company to generate useful information.

These pieces of information help business administrators put financial leverage to their most productive use. With inventory turnover analysis, managerial accountants can determine the cost of storing each unsold inventory. Optimizations can then be made to reduce the possibility or impact of excessive inventory. It helps to measure the amount of contribution a product has to the overall cost and profit of a company. Managerial accounting is a branch of accounting that deals with the compilation of financial records for internal decision-making.

Gain professional experience.

Financial accounting is created for its investors, creditors, and industry regulators. This report offers showcases the cost prices of items versus their selling prices for managers. The two-part CMA exam will test your knowledge of financial planning, performance, managerial accounting and analytics, as well as strategic financial management. There are plenty of different roles to choose from when it comes to managerial accounting. Regardless of where you are in your career, you can find an option that is within your reach.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

Who are the Users of Managerial Accounting Information

Nearly half (48%) of respondents said their firms already offer value-based pricing on some of their services, and 18% said their firms plan to start offering it by the end of the year. When rating investment priorities over the next two years, the priorities firms most often mentioned were improving processes and workflows and investing in tax-technology solutions. In fact, two-thirds (66%) of respondents said their firms were going to be streamlining their processes over the next two years, and 47% said they were eyeing new technology solutions, up from 41% in 2023. However, it is critical that firms not overlook the role that greater technology automation can play in easing bandwidth constraints and driving greater efficiencies.