Depending on your business, you can stay connected with your consumers via Facebook, Instagram, or Twitter. These days, it’s definitely to worthwhile to invest in social media marketing. These when are credits negative in accounting chron com platforms also allow you to target your intended customers. Social media can help promote events, post about promos and discounts, and create an image that is accessible for consumers.

- For working capital, it can range for seven to ten years, while purchasing equipment can have a ten-year payment term.

- On top of this, what if you have a startup loan you need to repay?

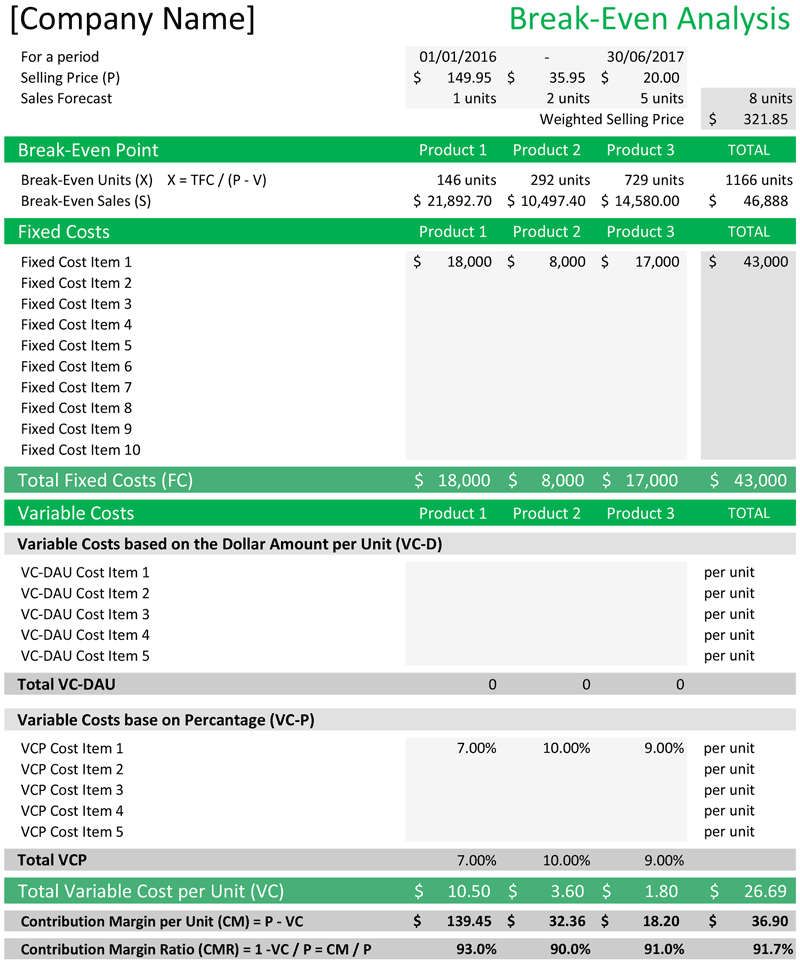

- The Break-Even Point (BEP) is the inflection point at which the revenue output of a company is equal to its total costs and starts to generate a profit.

- As mentioned earlier, determining your BEP can help you secure loans or persuade investors for your business.

Formula For Break-Even Point

Their strategy being to create demand and sustain that demand for as long as possible to keep the prices high. Cheaper phones manufactures will happily flood the market as they are looking at a smaller profit margin with the aim of high unit sales. Ideally, you should conduct this financial analysis before you start a business so you have a good idea of the risk involved.

Setting Business Goals (Key Performance Indicators)

It will quickly calculate the units you need to sell to reach the break-even point (BEP). With the break even result you can start to analyze the micro components that create the overall cost. Quantifying those components correctly allows you to identify areas where you may be able to cut costs. Often, new business owners do not get the results they need by simply putting ads. Remember that marketing is a process that entails planning and reaching goals. The usual ad strategies won’t necessarily bring more clients or sales to your business.

Break-even Analysis Calculator

Anything it sells after the 2,500 mark will go straight to the CM since the fixed costs are already covered. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). Variable costs are the costs that are directly related to the level of production or number of units sold in the market. Variable costs are calculated on a per-unit basis, so if you produce or sell more units, the variable cost will increase.

Using break-even analysis to determine level of production

Now we can take that concept and translate it into sales dollars. The main thing to understand in managerial accounting is the difference between revenues and profits. Many products cost more to make than the revenues they generate. Since the expenses are greater than the revenues, these products great a loss—not a profit. The break-even analysis calculator is designed to demonstrate how many units of your product must be sold to make a profit.

Thus, companies can only earn when their total revenue surpasses the break even point. That is why BEP is also referred to as the time it takes for a business to become profitable. On the other hand, if you keep earning lesser revenue than your estimated costs, your business will face losses. The break-even point is the point at which the total cost of production equals the total revenue generated. This formula helps you determine the total revenue required to cover your operating expenses, based on your business’s gross margin.

If your business sells a product, enter the cost of the components that go into making the product. Make sure to enter the component costs consistently relative to the unit selling price. Imagine you sell hotdogs, and you want to know how many hot dogs you need to sell to reach your BEP.

In other words, you should figure out if the business is worth it. Existing businesses should conduct this analysis before launching a new product or service to determine whether or not the potential profit is worth the startup costs. Break-even analysis works well for short-term planning, like setting immediate sales goals or dedication to prices. Let’s say you run a small bakery and plan to expand the bakery by opening a second location next year. Your break-even analysis alone won’t factor in the increased rent, higher utility bills, or additional staff wages. In this situation, it’s best to use forecasting tools like financial projections or budgeting software to account for future expenses and revenue growth.