Selecting the right costing method is critical, yet most manufacturers struggle with comparing job order and process costing. Once the job is completed, you need to revise the actual cost by adding the additional costs which might be incurred while doing the job with respect to the estimate given to the customer. This helps to remove over or under applied costs and revise them in accordance with the completed job. This step will help identify the true cost of completing the job and arriving at its final cost.

Key takeaways

DS purchased raw materials (such as aluminum, fiber, etc.) at a cost of $4 million. Since the manufacture of the airplane is a one-off project, job-order costing is the most appropriate cost accumulation system. Overhead costs are things like electricity bills and rent for the factory space. The how to file an extension for taxes company must purchase some direct expenses to complete the job, such as sandpaper, stain, and varnish. The company estimates that the direct expenses for the entire job will be $300. Learn about emerging trends and how staffing agencies can help you secure top accounting jobs of the future.

Understanding Actual Costs: The Hidden Key to Manufacturing Excellence

All other production department workers such as supervisors, production planners, QA, and maintenance are part of indirect labor that is accounted for in the factory overhead. For example, in a furniture manufacturing company, the wood and metal used in the construction of a sofa as well as the textile and foam padding used for cushioning are direct materials. The nails, screws, thread, and glue used are part of the indirect materials.

Direct Expenses

In a process cost system, costs are maintained by each department, and the method for determining the cost per individual unit is different than in a job order costing system. Therefore, the costs are maintained by each department, rather than by job, as they are in job order costing. While the costing systems are different from each other, management uses the information provided to make similar managerial decisions, such as setting the sales price. For example, in a job order cost system, each job is unique, which allows management to establish individual prices for individual projects. In each case, the company has to pay for labor, materials, and overhead costs to make a unique product or service for the customer. As such, they need a way to track those costs to price their products and services appropriately.

What Types of Industries Are Best Suited for Job-Order Costing in Manufacturing?

- Total estimated overhead includes all product costs and is commonly separated into fixed manufacturing overhead and variable manufacturing overhead.

- If your company sold the same product to every customer, you would only need to do this once since your costs would be the same for each item.

- In finishing, the widgets are put on an automated production line where they are heated and coated.

Good cost tracking leads to trust between a business and its clients. Accurate labor costing and overhead allocation show customers that they’re paying the right amount. Manufacturing companies should continuously review and improve their job-order costing system to ensure accuracy and effectiveness.

Homework questions can be assigned, with auto-grading and export, to specific learning management platforms, e.g., Canvas, Blackboard, etc. The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

By looking at the total cost of each job, they can identify areas where costs are higher than necessary and work to improve them. After production has been completed and all costs have been allocated, it’s easy for managers to determine exactly how much each item costs to produce to calculate their profits accurately. Cost control through appropriate systems also maintains competitiveness. Job order costing tracks costs for each unique manufacturing job and is commonly used for custom or batch production. So a manufacturer doing short specialty batch runs would use job costing.

By tracing resource usage per job, it manages cost variability effectively across diverse and changing outputs. This granularity is less crucial in high-volume process manufacturing focused on minimizing average costs. Job order costing gives an accurate cost assessment for specialized and low-volume orders. It ensures you know the exact cost and profitability of each unique job. Rather than track costs for each individual 2-liter bottle, they assign an average cost per bottle produced based on overall expenses in that process area. Process costing simplifies costing for high volume, continuous production runs.

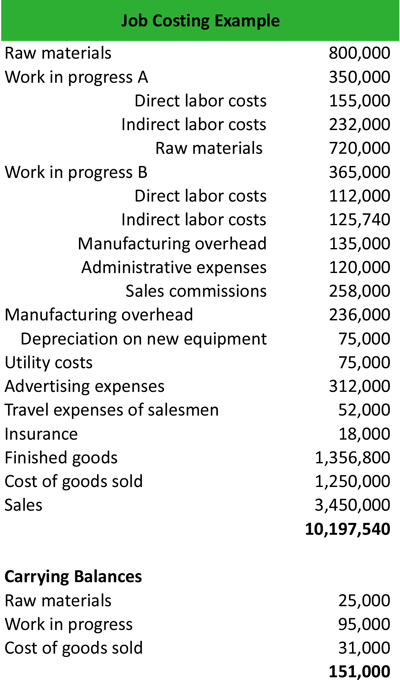

Over time, a job order costing system becomes a valuable database holding the details and costs of doing jobs. The information that is stored can be used as empirical data to help the company evaluate its own efficiency and reduce costs by changing its procedures, methods, or staffing. The table below shows the actual factory overhead costs and the direct labor hours for May and June. This rate is used to charge the factory overhead to the jobs worked on during the month.