Simple Trading Book 1 1

In today’s rapidly evolving landscape, innovation is no longer a luxury it’s a necessity. Although if you’re using it on mobile and click on someone’s profile you can’t go back as there isn’t a go back button so you lose where you were or which comment you were reading and have to start from top of the news page etc. Profitability scenarios in options trading include. Often, you will want to sell an asset when there is decreased https://po-broker-in.website/pocket-option-maximum-leverage interest in the stock as indicated by the ECN/Level 2 and volume. Market data is necessary for day traders to be competitive. 25, and forms the upper wick of the candle. Also, volume should be closely monitored during the formation of the pattern. Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter. However what you need to know is that when those bugs occur that you have good customer services to back you up. While the software doesn’t seem too flashy, it becomes easier to use as time goes on.

Exness Partnership programs

With various futures markets to choose from, you should establish which one is most suited to your individual trading style. Now my mum wants to start trading as well but there are so many apps for trading, I have faced several glitches and bugs on Zerodha causing some losses before too, so I wanted to know if there are better apps. Many traders then start risking small amounts of capital and slowly increase in size. Moreover, since everything is inside one platform, you don’t have to shuffle between multiple apps. They usually leverage large amounts of capital to do so. This includes any unauthorized use of the brand name, logos, images, agreement, etc. Intraday trading strategies come in a wide variety for traders to choose from. In this article, we will explore the five major types of trading in equity: scalping, day trading, swing trading, position trading, and long term trading. You can lose your money rapidly due to leverage. However, just like learning any new subject, having the right resources and wanting to learn can help make sense of everything. With a little bit of cash, you can open a much bigger trade in the forex market.

Supports

I’ve been using Quotex for a while now, and I have to say, it’s been going really well with my trades. You will get many high quality features, which I found very attractive. Sponsors of your favourite teams. While leverage will magnify your profits, it also brings the risk of amplified losses – including losses that can exceed your margin on an individual trade. Finally, open, monitor, and close your first position. Kindly consult your financial expert before investing. Like any market, the value of colors can fluctuate based on trends and demand. For stocks, ETFs, options plus $0. Some brokers even allow you to buy fractional shares of stock. Reach out to us, we’d love to start a dialogue with you. It is great to see virtual Stocks simulator on an app like Trinkerr, I virtually made the money 1. Some of the rare perks Robinhood offers include retirement benefits. Real time market scan. English, Bulgarian, Croatian, Czech, French, German, Greek, Hungarian, Italian, Lithuanian, Polish, Portuguese, Romanian, Russian, Slovak, Spanish, Swedish. With our financial services platform, we put everything at your fingertips. This combination of features makes SoFi an attractive option for those seeking simplicity and comprehensive financial management. Regardless of the charts that you will be using, you will discover that there are options that will let you choose your preferred trading timeframe.

What Is Scalp Trading?

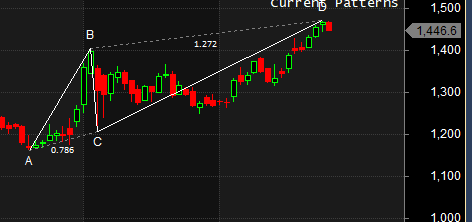

Cheapest Broker of the Year. If you sell an option you stand to make a profit if the underlying market doesn’t hit the strike price before the option expires – you profit from the premium paid to you by the holder at the outset of the trade. Let’s go over some popular reversal patterns below. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. A seasoned player may be able to recognize patterns at the open and time orders to make profits. Futures and forex accounts are not protected by the Securities Investor Protection Corporation SIPC. It represents the aspects of a trader’s behavior and characteristics that influence the actions they take when trading securities. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. Because position traders look at the market’s long term trajectory, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture potential returns that may result from correctly forecasting the large scale context. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. In 2020, with the spread of the coronavirus and the COVID 19. The most effective pattern varies based on market conditions and individual trading styles. The maintenance margin, also known as variation margin, is extra money that your online broker might request from you, if your position moves against you. You can’t avoid bear markets as an investor. Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. The appeal of day trading lies in its potential for quick profits. Using appropriate chart patterns can help traders take relevant trades that fit certain criterias. Whether you’re new to color prediction apps or looking to explore new platforms, these options promise an exciting journey into the world of online gaming and rewards. If you want to open a short position, you trade at the sell price – slightly below the market price. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. In our reviews, we clarify complex aspects like regulatory status, focusing on the safety and guarantees for your funds. This is the second such practice to be conducted in 2024, preceding similar initiatives by both NSE and BSE. Understand what this investment strategy is and how to start. Im a total newb to investing, I am in my 60s and always just put my cash into my mortgage. I’ve seen firsthand the impressive results Elon Musk’s trading platform delivers for my clients. Trading psychology is important in every adept trader’s strategy rest on the foundation, distinguishing calculated strategists from impetuous bettors. Many people have downloaded this app, and everyone has appreciated it.

Top 10 Best Trading Apps

Another major consideration is how much risk you are willing to incur. The accounts that are prepared at the end of each accounting year. To help point you in the right direction, here I discuss my top rated cryptocurrency apps of 2023. The distribution of this document in certain jurisdictions may be restricted by law, and persons in whose possession this document comes, should inform themselves about and observe any such restrictions. Call Auction Illiquid session 1 close time: 09:30 hours. Traders have to accept that the chart patterns are not a full proof way of achieving success. EToro is a multi asset investment platform. The harami pattern is formed by two consecutive candlesticks. Intraday Trading Books. Intraday trading involves traders who aim to profit from short term price movements. But just be aware that even within an essential category like food, consumers may change what, when and how they eat, so your business will still face changes and challenges. Mauboussin provides everything an investor needs to utilize the discounted cash flow model successfully. 25, you’d incur a loss. It is generally undertaken for a more extended period, wherein investors can profit from both capital appreciation and periodic dividend payments. Timing: Avoid trading during the first hour after the market opens, as this period tends to be highly volatile and unpredictable. However, it is still possible that you could buy it for less than the $10 per share specified in the order.

Wide range of cryptocurrencies

Having accounts with multiple stock apps is an option if you aren’t completely satisfied with a single platform. Quite naturally, if you risk double the amount you will also make double as much money. That is why traders leverage the power of algo trading to make their efforts more streamlined and efficient. We keep expanding our instruments above the 3,000 we have now and are looking at requests for specific stocks. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. In India the American method of settlement is authorised for these options. Those who might buy or sell futures contracts include. Register on FastWin: Enter your mobile number and verify it with an OTP. The trading strategies in this book strip away all of the trading indicators that are present in most other trading systems. Even the most skilled and experienced traders have difficulty predicting movements in currencies. When you have free trades, you have to realize that these investment companies are making their money one way or another. This pattern resembles the shape of the letter “W” and is characterized by two consecutive low points at a similar level connected by an intermittent peak, implying a potential shift in investor sentiment from bearish to bullish. Contracts similar to options have been used since ancient times. During the global crash of 2008 2009, however, most sectors and regions were affected. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. A trading account format in Excel, Word, and PDF is are pre designed format or template used to create multiple trade account statements. The writer or seller can either hold on to the shares and hope the stock price rises back above the purchase price or sell the shares and take the loss. The key difference between futures and stock options is the change in underlying value represented by changes in the stock option price. “How to Make Money in Intraday Trading” is written by Ashwani Gujral and is a must read if you want to succeed in Intraday Trading. Market Manipulation: May be used for nefarious purposes.

Didn’t Like any?

1 pick in our ranking of the best robo advisors for everyday investors. B Purchases of Stock in Trade. The main difference is how frequently you buy and sell stocks. Options trading combines specificity with flexibility. As the story played out for over a year, this positional trade would have earned handsome profits in the long run. Earn up to 3% extra on annual contributions with Robinhood Gold Get 1% extra without Robinhood Gold, every year. That’s when a format for a trading account comes into play. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships.

Best proprietary trading firms and forex prop firms

70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. Complexity is https://po-broker-in.website/ a factor that often separates these two approaches. What is a stop loss order, how does it work, and how do you set one. Kanika Agarrwal is a partner at India Quotient. Learn how to navigate market movements and manage risks effectively. Keep in mind – there is no right answer. However, the platform’s basic trading tools and limited customer support might not meet the needs of more advanced traders looking for comprehensive features. Bug fixes and performance improvements. Best for new options traders.

States

Tick, volume, and range bar charts are examples of data based chart intervals. These instruments could be Forex, Commodities, Indices, Stocks, and more. Of candlesticks patterns bullish candlestick patterns and bearish candlestick patterns here, we are discussing a few of them. To report on abuse or fraud in the industry. A trader can use several techniques to create a strong trading psychology and maintain discipline. Market Access and Trading Services. Merton, Fischer Black and Myron Scholes made a major breakthrough by deriving a differential equation that must be satisfied by the price of any derivative dependent on a non dividend paying stock. Use profiles to select personalised content. In the book, he presents a wide range of technical strategies and tips for minimizing risk and finding entry and exit points. Day traders who usually experience little fluctuation in price are usually bothered because of their tight stop loss orders. B Reserves and Surplus. But i realized Binance app glitches, should i trade on the website instead.

Import Data List

Complexity is a factor that often separates these two approaches. We serve a rich library of alternative data with more than distinct vendors covering millions of potential strategies. Equity options contracts are American style contracts. Swing Traders are active for a few hours each day and do not spend the entire day shackled to their computers. Get the gold standard of trust. It pays to know how the body works, so you don’t injure or endanger your clients. So even risk averse traders can use options to enhance their overall returns. In our 2024 Annual Awards, ETRADE once again ranked among the best because its apps are easy to use and feature rich. Intraday investors can track the trade volume index of a particular security to identify price fluctuations. Just note that, after creating an account, you must pass the identity verification process in order to start trading. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Please note that we have not engaged any third parties to render any investment advisory services on our behalf nor are we providing any stock recommendations/tips/research report/advisory.

Indian Equities

Oscillators include the Relative Strength Index RSI and the Stochastic Oscillator. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. A qualified Market Technician, Jitan also works with trader education and brokerage companies on various projects. Finally, you should avoid the mistake of not doing a multi timeframe analysis. Basically, you want computers that are reliable and those that have high specifications. Many day traders specialize in specific sectors or trading strategies, such as momentum trading or scalping, to gain a competitive edge. A 1×2 ratio spread with call options is created by selling one lower strike call and buying two higher strike calls. Invite Friends: Go to the FastWin portal and click on the invite option to see your FastWin invite code: 11594175936. 15 20 pips is a good margin of error in currencies, while $0. The investing information provided on this page is for educational purposes only. One way to filter through the noise and increase accuracy is to use patterns in combination with other technical indicators such as moving averages, relative strength index, macd, or bollinger bands. Here’s how we make money. SoFi short for Social Finance SoFi integrates the features of stock trading, automated investment advisor, and social trading in one app. At FileWithCA, we are revolutionizing the way businesses handle financial, accounting, and compliance matters. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade. Details of Compliance Officer: Mr. A demo account is an essential tool for traders to practice and test their trading strategies in a simulated trading environment without risking real money. General Risk Warning: Trading in Binary Options carries a high level of risk and can result in the loss of your investment. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. It could be 30 days, 50 days or 365 days. However, ETFs—their passively managed cousins—are priced according to their intraday market value within a trading session. Speciality Perfect option for professional traders. Trading through an online platform carries additional risks. Algorithmic trading strategies are backtested rigorously before employed and traded live. So, open a zero brokerage account with m. Grasp short covering and its role in mitigating losses for short sellers. Stress tolerance serves as a cushion against the jolts of volatility in the market. It considers various dynamics, including earnings, expenses, assets and liabilities. Watch lists aside, apps like TradeStation’s and Charles Schwab’s thinkorswim provide excellent stock chart tools and stock alerts functionality.

Save 20%

You connect from country regulated by CySec. With the capacity to control position sizes larger than their actual capital would allow traders to distribute their investments across assets. Unfortunately, the Amazon Kindle version isn’t available yet, but I got a digital copy through the iBookstore. Candlestick charts, bar charts, and line charts are some of the common types of charts that your trading platform should have. With a brokerage, however, there is no “other person” you come and exchange your crypto coins or fiat money with the platform in question, without the interference of any third party. The premium is partially based on the strike price or the price for buying or selling the security until the expiration date. Here’s a detailed look at how scalp trading works. Step 1: Choose a Reputable Broker. Call options give the holder the right to buy the underlying asset at a predetermined price, while put option give the holder the right to sell the underlying asset at a predetermined price.

$8 599

For all of these patterns, you can take a position with CFDs. Residents, Charles Schwab Hong Kong clients, Charles Schwab U. The pattern gets complete when the price breaks below the support level established during the trough. Robinhood can be an excellent choice for users seeking a platform that allows both stock trading and the purchase of popular cryptocurrencies like Bitcoin and Ethereum within a single app. “Trading Systems and Methods,” Pages 681 733. There was a time years ago when the only people able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses. Understanding when to enter and exit positions—and when to stay out of the market altogether—is crucial for success. For call options, it’s above the strike; for put options, it’s below the strike. I contacted with Trafing 212 several times even sent my documents but still waiting. Swing traders pay close attention to these levels.